Who are we?

Modeling the Corona Crisis

Involvation and Flostock decided to combine the broad Supply Chain Planning expertise of Involvation (consultancy, learning & development and interim management) with the highly specialized volatility modelling expertise of Flostock (bullwhips, pork cycles, Lehman waves, runaways). At the moment we model the effects of the Corona Crisis in the automotive industry. We believe we can help big and small companies in all tiers of the long and divers automotive supply chains understand and manage their business. You can contact us here.

Interview with GlobalAutoIndustry.com

In an interview on the 5th of June, 2020, Ron Hesse of GlobalAutoIndustry.com questioned Robert Peels (pictured) about his unorthodox, but scientifically proven view on the cause of the bullwhip, and more in particular about the bullwhip in the global automotive industry. Click here to go to the interview or visit GlobalAutoIndustry.com.

Quotes

"If we can forecast the petrochemical cycle, we can earn a shitload of money! "

Enthusiastic Business Unit Director in Leverkusen after hearing a Flostock presentation.

“From laborious econometric modelling to fast paced simulation techniques - that is how Flostock implements its visionary insight into economic cycles and the multiplier effects that impact the supply chain. Flostock’s approach is highly useable and may save millions by allowing companies to optimize production, stock building and supply chain design. Where others continue to use spreadsheet scenarios based on gut feel and yet others try to apply unwieldy traditional forecasting models; the winners of tomorrow may very well be clients of Flostock”

Jos Huijbregts, Econometrician and CFO

“By incorporating the effect of inventory movements, Flostock transforms demand modelling from a “black art” into reliable science.”

Machiel Keegel, VP Strategy, Tronox

“The project helped us to better understand our market dynamics in terms of capacities, utilization rates and stocking behavior and helped us to implement a structured approach to include market & industry intelligence in operations and its general business steering. With the model we are better able to create insight on this and to show its impact on our business and future decision making. The Flostock staff quickly understood our business and was able to translate this into a good functioning model. “

Dennis Rijnders, Business Manager DSM Food Specialties.

“Interesting presentation; intense. For part of the audience it was way over their head. But the bigger part was sitting on the edge of their chair. Great how you took possession of the stage and the audience. The most interesting presentation of the day.”

Spontaneous comment after CEPE conference in Sevilla.

“… you’ll be pleased to know that you’re name was mentioned a few times as a top speaker, but also your presentation for making people want to attend.”

Steven Craigh after Logichem conference in Dubai.

Flostock history

Flostock is a consultancy firm with its main focus on the manufacturing industries in Europe. Demand for upstream companies is ultimately determined by expenditure in the downstream end markets. But, the supply chain in between acts as a buffer. If we can capture the behavior of the supply chain in a model, it is possible to translate expenditure in downstream markets, such as construction or automotive, into upstream demand. The stock building of firms in the supply chain is for a large part based on the variations in downstream demand. The Flostock models take this stock building behavior into account.

Flostock Stock & Flow Analyses was founded in 2011 by Robert Peels, who as strategy director for Royal DSM had published a series of articles around the causes for the enormous dip in the manufacturing industry during the financial crisis, many of them together with professor Jan Fransoo and Maxi Udenio of Eindhoven University of Technology. Maxi Udenio received his PhD on this subject in 2014 and became assistant professor at the University of Leuven. Jan Fransoo is now professor of Operations Research and Logistics as well as Dean of Research at Kühne Logistics University in Hamburg. Peels, Fransoo and Udenio together also developed a method of model building, as described in their publications.

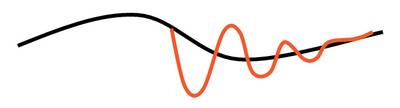

- The black line is the long term economic curve with a wavelength of multiple years. When Lehman Brothers went bankrupt a shock went through the world and everybody started de-stocking at the same time. Companies higher up the chain experienced this as cumulative de-stocking of all the players between them and the end-market. This curve we have called the “Lehman Wave”. Because it is a wave, with a wave character, it can be described and its cause can be predicted.

Active de-stocking caused the Lehman Wave

The large impact of stocks became clear when the financial crisis broke out after the bankruptcy of Lehman Brothers on 15 September 2008. The resulting peak in the Libor interest rate caused a massive reduction in credit and a cry for Cash is King all over the world. Companies started on mass to reduce their stocks (so-called Active de-stocking, causing a so-called Lehman Wave. Companies high up the supply chains experienced a 40-60% reduction in sales, while their end markets were stable.

Modeling

Flostock builds models based on System Dynamics principles, using the proprietary Flostock method. This allows us to build a simulation model in which we can include the inventory behavior across an entire supply chain. System Dynamics was described by Forrester in 1961 and more recently by Sterman in 2000. It should be noted that our models make a connection between the macro world (end markets economic indicators such as retail, automotive sales or building & construction) and the micro world (the demand at your level in the supply chain). Although many macro economists are allergic to this, we have found that we can get surprisingly good results.

Endorsements

Flostock’s ideas have been published in many newspapers and journals, including the Financial Times, major Dutch newspapers such as NRC and Financieel Dagblad, the European Coating Journal, Chemistry Today, Ink World, EVO Logistics and ICIS Chemical Business. In October 2013 McKinsey publised an overview article about lessons from the crisis, in which Flostock's vision was prominently quoted. BusinessInsider listed our Lehman Wave article among the 8 business cycle theories that explain the current world. For an overview of all publications, see the publication list.

Presentations have been given at numerous conferences, including Logichem (3x Antwerp, 1x Dubai), CEPE in Sevilla, SC Innovation Summit in Antwerp, ESCF in Eindhoven, ECJ in Berlin, ECCA in Brussels, Portorez Conference in Llubljana, EDPN in Amsterdam, ICIS Olefins in Amsterdam, Elastomers in Aachen, ACE Olefins in Amsterdam. the ministery of the interior, three times on the annual Dutch conference on business cycles ("Conjunctuurdag") and the Dutch Central Bank. The Rabobank, Bank de France, Erasmus, Cambridge and the ECB quote our work. Eindhoven University, Wharton (Philadelphia) and MIT in Boston use our insights in their teaching.

Flostock is a consultancy specialized in volatility, with a concept that has been described in series of journals and newspapers, including the Financial Times and ICIS Chemical News. See Publications & News for a full list. Our insights have been adopted in the curriculum of Wharton, MIT, and at least 6 European universities. McKinsey in 2013 called our approach best practice in the crisis.